Key Takeaways

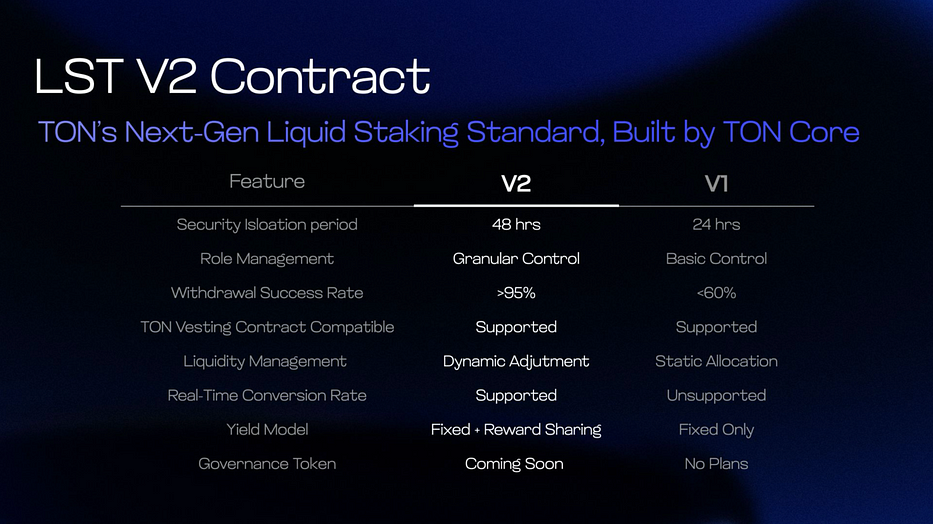

- TonCore LST V2 sets a new benchmark for liquid staking on TON, offering enhanced security, flexible withdrawals, and superior DeFi composability compared to LST V1.

- KTON leverages the power of LST V2 to deliver institutional-grade security and a seamless staking experience for both retail and institutional users, with fast liquidity that will continue to improve as the protocol grows.

- Tonstakers, built on LST V1, remains a trusted option but is inherently limited by older architecture, especially in flexibility, upgradeability, and governance.

- KTON’s Telegram Mini App and low entry barrier make staking accessible to hundreds of millions, driving mainstream adoption across the TON ecosystem.

- With a dual-token governance model and DAO roadmap, KTON empowers community-driven growth and sustainable protocol evolution.

- For users and institutions seeking future-proof staking, KTON stands out as the superior choice to unlock TON’s multi-billion dollar liquid staking potential.

The Evolution of Liquid Staking on TON

The TON blockchain is rapidly gaining traction in Web3, powered by its integration with Telegram and an expanding DeFi ecosystem. As staking becomes central to securing the network and rewarding users, the downside of traditional staking-locked assets and lost liquidity-becomes clear.

Liquid staking solves this by letting users stake TON and receive a liquid staking token (LST) in return. This token can be traded, used in DeFi, or redeemed later — preserving rewards while unlocking capital efficiency.

But not all liquid staking is equal. The move from LST V1 to LST V2 is more than a technical upgrade. It impacts security, flexibility, and how users and institutions engage with the TON ecosystem.

KTON is built on the LST V2 standard, offering a future-proof solution designed to unlock TON’s liquid staking potential, drive DeFi growth, and set new benchmarks for security and composability. Early solutions like Tonstakers, based on LST V1, laid the groundwork but faced growing limitations.

In this series, we’ll break down the differences between LST V1 and V2, and show how KTON is positioned to lead the next phase of TON’s evolution.

Understanding Liquid Staking Standards on TON

LST V1: The Foundation

Liquid staking on TON began with the LST V1 standard, which introduced essential components, which are a pool contract to aggregate deposits, controller contracts for validator operations, and Jetton tokens to represent user shares. This model allowed users to earn staking rewards while retaining a liquid asset.

LST V1 Limitations

Despite its achievements, V1 architecture revealed several constraints:

- Complex Role System

V1’s role system (Governor, Approver, Halter, Sudoer) introduced complexity and potential centralization points

- Withdrawal Friction

V1 offered “strict” withdrawals (requiring waiting for validation cycle end) and “optimistic” withdrawals (faster but with limitations)

- Limited Standardization

Lack of unified interfaces made DeFi integration challenging

- Rigid Upgradeability

Less flexible permission structure complicated protocol upgrades and emergency responses

LST V2 Advancement

V2 represents a comprehensive upgrade addressing these limitations:

- Enhanced Security

Introduces parameters like credit_start_prior_elections_end to prevent liquidity drains and reduce “bank run” risk

- Optimized Liquidity

Debuts fast withdrawal fee mechanism, enabling instant withdrawals when liquidity permits

- Greater Standardization

Standardizes token interfaces and on-chain query methods for easier DeFi integration

- Future-Proof Governance

Expands governance hooks, introduces a dedicated treasury, and supports safer upgrades

- Scalability

Offers modular design improvements and configurable parameters for easier maintenance

KTON’s Implementation of LST V2

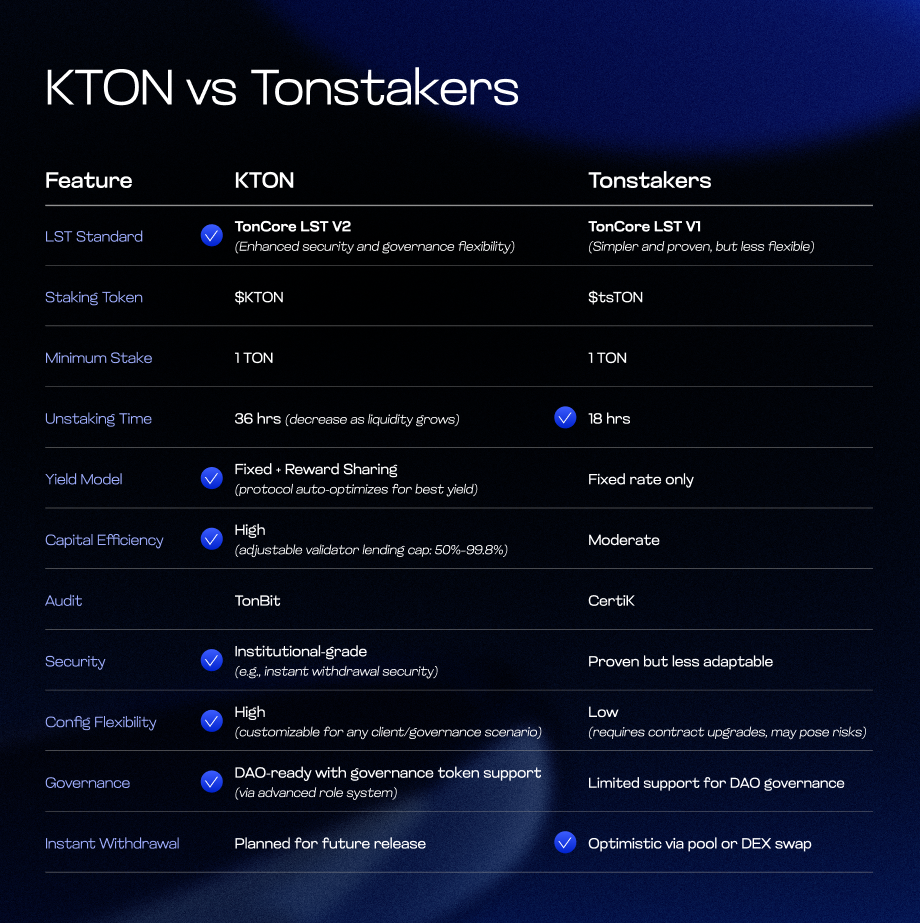

KTON emerges as the first protocol to fully embrace the LST V2 standard, implementing its advanced features to deliver:

- Institutional-Grade Security

Advanced risk controls, granular permission management, and safer upgrade mechanisms make KTON attractive to institutions and exchanges

- Unmatched Liquidity

Users can access funds instantly when liquidity allows, with a transparent fee structure supporting the protocol’s treasury

- DeFi Composability

Built on standardized interfaces, $KTON is designed for seamless integration across the TON DeFi ecosystem

- Future-Proof Governance

A dual-token model separates staking rewards ($KTON) from governance power, promoting healthy community participation

- Transparent Rewards

Competitive APY with clear, predictable returns and transparent fee structures

Tonstakers: The First Step in TON Liquid Staking

As the first liquid staking protocol on TON, Tonstakers helped define the category. Built on LST V1, it quickly gained traction with strong TVL and wide ecosystem integration.

Tonstakers’ Approach

- Established Trust

Millions of TVL and a great user base, with CertiK-audited smart contracts (AA security rating)

- User Experience

Offers instant withdrawals via liquidity pools (sometimes with less favorable rates) and “best rate” withdrawals (waiting up to ~18 hours)

- DeFi Integration

tsTON is widely accepted across TON DeFi, tradable on major DEXs, and usable as collateral

- Competitive Rewards

APY of ~4.1–4.23%, with rewards auto-compounded every ~18 hours

Product-Specific Challenges

- Liquidity Dependence

Instant withdrawals rely on external liquidity pools, potentially exposing users to slippage

- Limited Governance

No dedicated governance token or widely publicized DAO, limiting community participation

- Integration Complexity

While widely integrated, lacks some standardization benefits of V2

Head-to-Head Comparison: KTON vs. Tonstakers

TON’s Liquid Staking Future

The TON ecosystem is entering a new phase where security, flexibility, and DeFi integration are paramount. KTON and LST V2 address these needs by providing:

- Security at Scale

Engineered for institutional-grade security with advanced risk controls

- Liquidity Without Compromise

Aims to eliminate withdrawal uncertainties that deter users from staking by introducing a fast withdrawal fee mechanism and liquidity management parameters

- Composability

Standardized interfaces make it ideal for next-generation DeFi protocols

- Mainstream Adoption

Telegram Mini App lowers the barrier to staking for hundreds of millions

- Institutional Readiness

Robust, scalable staking infrastructure for family offices, funds, and exchanges

- DeFi Catalyst

Positioned to become the backbone of TON’s maturing DeFi ecosystem

KTON: Gateway to TON’s Billions Staking Opportunity

The TON ecosystem is entering a new era defined by security, flexibility, and seamless DeFi integration. KTON stands at the forefront of this transformation, delivering institutional-grade security, instant liquidity, and a user experience designed for both crypto natives and new users entering via Telegram.

For those seeking both staking rewards and capital efficiency, KTON offers a future-proof solution. Whether you’re a retail user looking for easy staking, an institution demanding robust risk controls, or a developer building TON DeFi, KTON provides the infrastructure, trust, and flexibility you need.

The future of staking on TON is liquid, secure, and community-driven. The future is KTON.

Stake smarter. Choose KTON. Become part of the new TON era.

To explore KTON’s features firsthand, visit kton.io or access the KTON Mini App via Telegram: https://t.me/ktonio_bot

About KTON

KTON is a next-generation liquid staking protocol built for the TON ecosystem, unlocking liquidity for both institutional and retail users. Through its liquid staking token $KTON, users earn staking rewards while accessing TON’s growing DeFi landscape. Backed by institutional-grade security, decentralized governance, and seamless DeFi integration, KTON drives the growth of Telegram Finance and mass adoption.