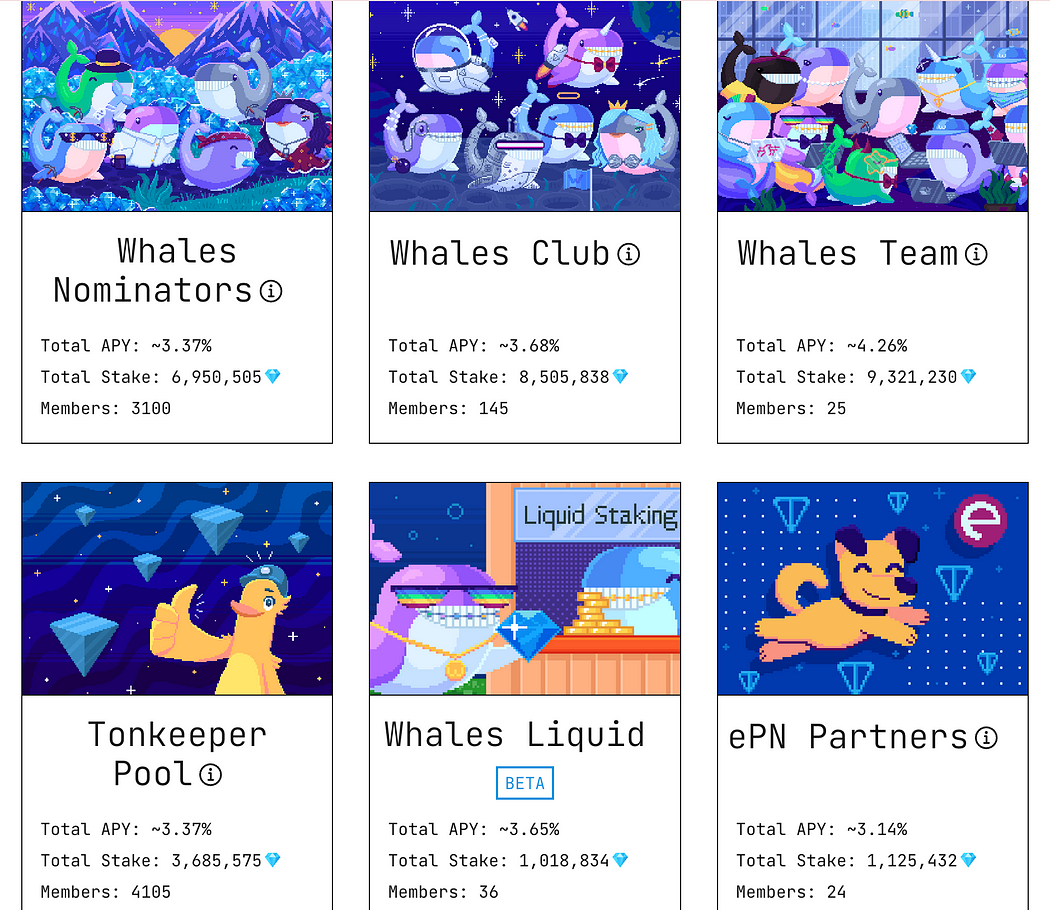

The TON blockchain has rapidly evolved into a powerhouse for decentralized applications, fueled by its integration with Telegram and a thriving ecosystem of over 1 billion monthly active users. At the heart of this growth lies staking, a critical mechanism for securing the network and generating passive income.

In case any of you are not yet aware, yes, TON has staking. It allows users to participate in network security by locking their tokens in a validator or delegating them through nomination. For TON holders, the choice between native staking and liquid staking isn’t just technical, it’s strategic.

This guide dissects the seven key differences between these approaches, tailored to TON’s unique architecture. Whether you’re a retail investor or a DeFi enthusiast, understanding these nuances will help you optimize returns while balancing risk and liquidity.

1. Liquidity: Locked Assets vs. Flexible Capital Utilization

TON Native Staking Capital

When you stake TON natively, tokens are locked in the network’s Elector smart contract for the duration of the validation cycle (~18 hours per epoch). This creates an opportunity cost, that is your assets can’t be traded, used as collateral, or deployed in DeFi protocols like STON.fi or EVAA Protocol until unstaked. This process ensures network security but limits asset flexibility.

TON Liquid Staking Capital

Platforms like Tonstakers and the rising protocol, KTON issue liquid staking tokens (LSTs) such as kTON or tsTON that represent your staked TON. These LSTs:

- Automatically accrue rewards

- Trade freely on DEXs

- Integrate with TON’s DeFi ecosystem

Unlike traditional staking, liquid staking allows users to earn staking rewards while maintaining the ability to use their assets in DeFi applications. Liquid staking is a method where staked assets remain usable while earning staking rewards, whereas native staking locks assets for a fixed period.

Native Staking Minimum TON Requirements

To run your own validator node on TON, you’ll need to stake a minimum of 500,000 TON (approximately $1.49M as of May 2025) for a single-round validator. Many top staking providers, like Kiln, recommend staking even more — around 700,000 TON — to improve your chances of being selected and earning rewards. This high requirement means that running a validator is usually only possible for institutions or very large holders, not everyday users.

Validators can choose to participate in just one round (called a “single-round validator”) or both rounds (“dual-round validator”). If you stake 500,000 TON, you can join one round. To be active in both rounds at the same time, you need at least 1,000,000 TON (500,000 TON for each round). There’s also a cap — putting more than 1,500,000 TON in a single round, or 3,000,000 TON across both rounds, doesn’t increase your rewards or chances of being selected.

Since these amounts are out of reach for most people, TON offers another option called nominator staking. As a nominator, you can lend your TON to validators and earn a share of their rewards. The minimum amount to participate is much lower — depending on the pool, it ranges from as little as 0.1 TON (Bemo V1) to 10,000 TON (TON Foundation Open Nominator Pool), making it accessible for regular users. The main options are:

- TON Foundation Open Nominator Pool (Traditional Nominator Pool):

This is the official pool developed by the TON core team. It allows up to 40 nominators to pool funds, but each nominator must stake at least 10,000 TON. The pool is open source, secure, and trusted for its transparency. However, the high minimum and limited pool size make it less accessible for small holders. The contract is complex, which makes auditing and scaling challenging. Nominators still face slashing risk if the validator is penalized, and there is no insurance or compensation mechanism.

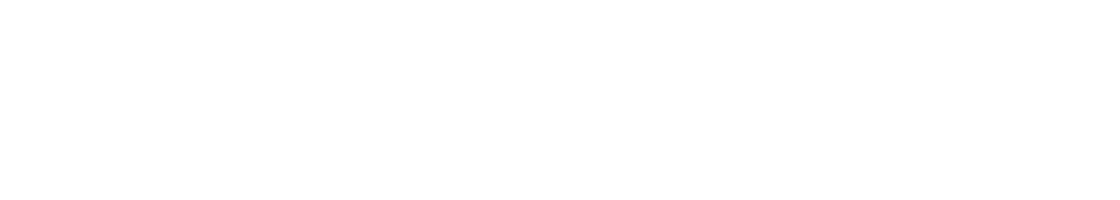

- TON Whales Nominator Pool:

Operated by Whales Corp, this is the most popular and accessible nominator pool, with a minimum stake of just 50 TON. It is professionally managed, offers stable returns (about 3.3–4.2% APY), and is integrated into major wallets, making it user-friendly. The pool is governed by DAO contracts for commission transparency and uses multiple validator partners. However, it is more centralized, as users rely on Whales Corp’s management. The pool charges a 10% platform fee (plus 10% to validators), and nominators share the risk if a validator is penalized. Users should also avoid staking from custodial wallets to ensure they can withdraw their funds.

- Single Nominator Contract:

Designed for large holders or institutions, this contract allows a single user to stake and control their funds directly, with no shared risk or reward splitting. The minimum is usually 354,000–700,000 TON, depending on the provider and network conditions. It provides the highest security, separating cold and hot wallets, and is fully audited. Only the owner can withdraw funds, while the validator node can only use the stake for validation. This option is not suitable for small holders and requires technical expertise to operate, but it is the standard for professional and institutional staking on TON.

- Bemo V1:

As TON’s first liquid staking protocol, Bemo V1 functions similarly to a nominator pool but adds liquidity: users can stake as little as 0.1 TON and receive a tradable stTON token. Bemo is CertiK-audited and offers extra incentives, but it is more centralized (the Bemo team controls validator selection), charges a relatively high fee (20% total), and has a 48-hour withdrawal waiting period. There is no explicit slashing insurance, and initial DEX liquidity for stTON was limited.

Each option balances accessibility, security, fees, and decentralization differently. TON Whales is the most accessible for everyday users, the Foundation pool is the most official but has a high entry bar, the Single Nominator contract is best for large holders seeking maximum security and control, and Bemo V1 is for those who want liquidity and very low minimums, but with higher fees and more centralization.

Liquid Staking Minimum TON Requirements

Protocols significantly reduce entry barriers, with liquid staking platforms like KTON, Bemo, and Tonstakers offering for as little as 1 TON.

This means that liquid staking provides a more inclusive approach, allowing smaller investors to participate in staking with minimal capital. Native staking, on the other hand, is the conventional form where tokens are locked directly into the network for securing and validating transactions.

3. Reward Mechanisms: Fixed APY vs. Compounded Yield

Traditional staking provides stable returns, whereas liquid staking compounds earnings and integrates with DeFi for additional yield opportunities. The key difference between traditional staking and liquid staking is that traditional staking locks assets, while liquid staking provides a tokenized version that can be traded or used in DeFi applications.

4. Risk Exposure: Network & Pool-Specific Risks vs. Additional Layer Risks

Native Staking Crypto Risks

Native stakers are primarily exposed to network-specific risks, such as:

- Slashing: Validators are penalised for being idle and behaving maliciously, which may result in a 101 TON fine deducted from the validator’s total stake. As a nominator, if your validator is penalized, your staked amount will be affected.

Native staking ensures security but requires diligence in validator selection.

In addition to slashing, each nominator type on TON faces its own specific risks:

- TON Foundation Open Nominator Pool:

Nominators face risks related to the pool’s complex smart contract design, which increases the potential for bugs or vulnerabilities. The pool is limited to 40 users, and there is no insurance or compensation for slashing losses — nominators share losses proportionally if the validator is penalized. Withdrawal flexibility may be limited if the pool is full, and nominators must trust the pool owner’s management of key parameters, though the pool is open source and well-tested.

- TON Whales Nominator Pool:

Nominators rely on centralized operational control by Whales Corp, including validator selection and fee management. There is no insurance for slashing, so all nominators share the risk if a validator is penalized. The pool charges a 18% platform fee, and users must avoid staking from custodial wallets to ensure they can withdraw their funds. While DAO governance provides some transparency, ultimate control remains with the operator.

- Single Nominator Contract:

This option offers the highest security and minimal attack surface, but is only suitable for large holders who can manage their own validator. The staker bears full responsibility for validator performance and any slashing, with no risk sharing. It requires technical expertise to operate securely and does not diversify risk across multiple validators or pools.

- Bemo V1:

Nominators are exposed to high centralization risk, as the Bemo team controls validator selection and contract upgrades. There is a 20% total fee (10% to node operators, 10% to Bemo), and a 48-hour withdrawal waiting period may limit liquidity. There is no explicit slashing insurance; nominators share losses if validators are penalized. Users must also trust Bemo’s operational integrity and security practices.

In summary, while all native nominators are exposed to network-level risks like slashing, each pool or contract introduces its own risks — such as contract complexity, centralization, fee structure, withdrawal limitations, and operational trust. None of these options currently provide insurance or compensation for slashing losses, so nominators always share the impact if their validator is penalized.

Liquid Staking Crypto Risks

Liquid staking crypto introduces additional layers of risk regardless of protocols, such as:

- Market risks: The LST that brings the additional yield also comes with a risk of volatility that may cause decreased liquidity and value, which will affect your rewards.

- Smart contracts vulnerabilities: Smart contracts used to automate the creation and management of LSTs may carry bugs or vulnerabilities that could be exploited. While this risk exists across all DeFi protocols, the TonCore Liquid Staking V2 contract — implemented by KTON and audited by TonBit — introduces enhanced security mechanisms to mitigate these threats. These advancements mark a significant step toward securing staked assets within the TON ecosystem.

- De-pegging: There is a risk that the LST token could de-peg from the underlying TON token.

While liquid staking enhances accessibility and yield potential, it carries smart contract and market-related risks.

KTON Mitigation

KTON sets itself apart as the first protocol to fully implement the TonCore Liquid Staking V2 contract, a significant milestone in enhancing security and reliability within the TON ecosystem. This contract, developed by the TonCore team with direct contributions and support from KTON, has undergone a comprehensive security audit by TonBit, the designated Security Assurance Provider (SAP) for TON.

You can view the full report here.

The V2 contract introduces critical upgrades, including enhanced role management, improved stability, and advanced risk controls, addressing vulnerabilities seen in earlier iterations. Additionally, KTON independently developed and deployed its own controller infrastructure, making it the only live implementation of the V2 contract to date. These advancements position KTON as the most secure and institution-ready liquid staking protocol on TON, ensuring user funds are safeguarded while delivering consistent returns.

5. Accessibility and User Experience: Technical Complexity vs. Simplicity

TON Solo Staking Workflow

Becoming a native staker on TON as a validator, which involves significant technical expertise and infrastructure setup. Users must:

- Operate high-performance hardware (e.g., 16-core CPU, 1TB NVME SSD OR Provisioned 64+k IOPS storage).

- Manage validator election cycles and key rotations.

This complexity limits native staking primarily to institutions or technically skilled individuals.

TON Liquid Staking Workflow

Liquid staking eliminates these barriers by offering a user-friendly and seamless staking experience through platforms like KTON. Users can:

- Avoid managing hardware or validator operations.

- Use intuitive interfaces integrated with popular wallets like Tonkeeper or Tonhub.

Here’s how to stake TON on KTON:

- Visit kton.io or open Telegram and search “ktonio” or click https://t.me/ktonio_bot

- Connect TON wallet (choose from available options)

- Make TON deposits to the wallet

- Click “Stake”

- Enter the amount you want to stake

- Receive LSTs in <2 minutes

Liquid staking simplifies staking participation, making it accessible to all users without requiring technical knowledge. When comparing liquid staking vs. native staking, liquid staking offers more flexibility, while native staking provides direct security contributions to the network.

6. Future-Proofing: Static Returns vs. DeFi Composability

Liquid staking positions TON holders for emerging opportunities:

- Trading & liquidity provision: LSTs can be traded on decentralized exchanges (e.g., DeDust, STON.fi) and deposited into liquidity pools on these same DEXs, allowing users to earn transaction fees and additional rewards while still receiving staking benefits.

- More returns: LSTs can be used in DeFi protocols to earn additional yields (e.g., providing liquidity to the KTON pool on Titan.tg to earn up to 28% APR)

- Collateralization: LSTs can be leveraged as collateral for loans or other financial instruments

This flexibility makes liquid staking a more dynamic and future-ready option for TON holders.

7. Governance Participation: Direct Voting vs. Delegated Influence

TON Native Staking Advantage

Native staking allows TON holders to directly participate in governance decisions by running their own validator nodes. Validators have a say in network upgrades, protocol changes, and other critical decisions. This direct involvement gives native stakers more control over the future of the network, aligning their financial and governance interests.

TON Liquid Staking Governance Model

In liquid staking, governance participation is typically delegated to validators or the platform managing the pooled funds. This delegation simplifies the process for users, allowing them to focus on earning rewards without needing to engage directly in governance decisions. While this means individual liquid stakers have limited direct voting power, platforms like KTON DAO can amplify their collective influence by representing stakers in key network decisions.

Similar to how Lido DAO has become a significant player in Ethereum governance, influencing validator diversity and ecosystem health, KTON DAO has the potential to shape the TON ecosystem by consolidating voting power and advocating for improvements that benefit all stakeholders. This balance of convenience and representation ensures that liquid staking remains a practical and impactful option for TON holders.

Strategic Takeaway: KTON’s Unique Position in TON’s Liquid Staking Ecosystem

While Tonstakers dominates TON’s liquid staking, KTON introduces groundbreaking features that set it apart:

- Secure and advanced infrastructure: KTON is the first protocol to fully implement the TonCore Liquid Staking V2 contract. Developed with direct contributions from KTON and audited by TonBit, this contract introduces enhanced role management, strengthened stability, advanced risk controls, and institutional-grade security.

- Governance token: Reflecting its commitment to decentralization, KTON plans to launch a governance token that will empower the community to participate in platform decisions and shape the future of TON’s DeFi ecosystem.

- DeFi ecosystem development: By collaborating with leading TON-native DeFi protocols and integrating with major projects entering TON, KTON plays a pivotal role in expanding DeFi, driving innovation and adoption across the ecosystem.

For investors eyeing the next leap in TON’s DeFi landscape, KTON’s roadmap, and U.S. expansion, positions it as a protocol to watch. With its cutting-edge infrastructure and strategic focus on community-driven governance and ecosystem growth, KTON is shaping the future of staking on TON.

Aligning Staking Strategy with TON’s Evolution

TON’s staking landscape mirrors its ecosystem, dynamic and user-centric. Native staking remains vital for network security but suits whales. Liquid staking, led by Tonstakers and innovated by KTON, democratizes access while unlocking composable yields.

As TON targets 500M Telegram users by 2028, liquid staking’s liquidity solutions will likely drive mainstream adoption. For holders, the choice isn’t binary: diversifying across both methods balances yield optimization and network contribution.

Ready to maximize your TON? Explore KTON for institutional-grade liquid staking with retail accessibility, a gateway to TON’s next growth phase.

Ready to stake your TON? Visit kton.io or t.me/ktonio_bot today!

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Cryptocurrency staking involves significant risks, including potential loss of principal. The value of cryptocurrencies can be volatile, and past performance is not indicative of future results. KTON and related products mentioned may be subject to technical, regulatory, and market risks. Users should conduct their own research before staking any assets. By using this information, you acknowledge that you are solely responsible for your financial decisions.

About KTON

KTON is a next-generation liquid staking protocol built for the TON ecosystem, unlocking liquidity for both institutional and retail users. Through its liquid staking token $KTON, users earn staking rewards while accessing TON’s growing DeFi landscape. Backed by institutional-grade security, decentralized governance, and seamless DeFi integration, KTON drives the growth of Telegram Finance and mass adoption.