Key Takeaways

-

TON Whales Nominator pools were pioneers in making staking accessible on TON, allowing users to pool funds and participate in validator rewards with lower minimums than solo staking.

-

The architecture of Whales Nominator pools is straightforward but owner-controlled, with rewards distributed proportionally among nominators.

-

While accessible, Whales Nominator pools have notable limitations, which are withdrawal delays tied to validation cycles, lack of DeFi composability, and centralization risks due to owner control.

-

Next-generation liquid staking protocols like KTON’s LST V2 address these challenges by offering liquid staking tokens, faster and more flexible withdrawals (as liquidity grows), enhanced security, and seamless integration with the TON DeFi ecosystem.

-

For institutions and advanced users, the evolution from traditional nominator pools to liquid staking solutions like KTON marks a significant shift in flexibility, security, and capital efficiency within the TON ecosystem.

As the TON blockchain ecosystem matures, staking has become a central pillar for both network security and user rewards. The emergence of staking pools and liquid staking protocols has democratized access, but not all solutions are created equal.

In this article, we examine the TON Whales Nominator – one of the earliest and most prominent nominator pools on TON – and compare its architecture, user experience, and risk profile to next-generation liquid staking solutions like KTON’s LST V2.

This analysis aims to provide institutions, staking enthusiasts, and the broader TON community with a clear, fact-based understanding of their options in the evolving staking landscape.

Understanding TON Nominator Pools

What is a Nominator Pool?

A nominator pool is a smart contract-based mechanism that allows multiple users (nominators) to pool their TON and collectively delegate it to a validator. This approach enables participants who lack the high minimum stake required for solo validation to still earn staking rewards and contribute to network security. The TON Whales Nominator was the first such pool on TON, quickly gaining traction after the launch of the whales smart contract and becoming a reference point for collaborative staking.

Core Structure

The TON Whales Nominator pool is built from several smart contracts:

-

Owner: Controls critical updates, fee structures, and pool management. The owner receives all profits from fees.

-

Controller: Issues staking commands, manages validation, and ensures the pool operates smoothly.

-

Proxy: Represents the pool in the masterchain, acting as a bridge to the network’s elector contract.

-

Pool: The main contract that tracks all stakes and handles the actual staking process.

It’s important to note that each nominator pool on TON is independently developed and operated. For example, the TON Whales team created and manages their own pool, with a minimum deposit of 50 TON. The TON Foundation, on the other hand, developed an open nominator pool contract (minimum 10,000 TON) as a reference implementation, but does not operate a pool for users. Each pool has its own unique contract and management, allowing for different minimums and fee structures.

How the TON Whales Nominator Works

Deposit and Withdrawal Process

-

Depositing: Users send a stake (plus a deposit fee) to the pool. The pool owner has discretion to accept or reject the stake.

-

Withdrawing: Withdrawals also require two steps — requesting the withdrawal and, once solidified (often after a validation cycle), executing the withdrawal.

Operational Details

-

Validator Election: The pool participates in TON’s validator election cycles, alternating between odd and even pools for seamless network operation.

-

Minimum Balances: Pools must maintain a minimum balance (e.g., 10 TON) for network storage fees and operational costs, which can total ~105 TON per month.

-

Rewards Distribution: When the validator earns rewards, these are distributed among all nominators proportionally.

Pros and Cons of TON Whales Nominator

Pros

-

Accessibility: Low minimum deposits (as low as 50 TON) make staking accessible to a broad user base.

-

Decentralization: By pooling resources, more users can participate in network security.

-

Simplicity: The process is straightforward for those familiar with basic blockchain transactions.

Cons

-

Withdrawal Delays: Withdrawals are tied to validation cycles, often resulting in waiting periods of up to 36 hours or more, especially when liquidity is low.

-

Owner Centralization: The pool owner has significant control, including the ability to reject deposits and manage fees, introducing centralization risks.

-

Limited Flexibility: Users cannot use their staked assets in DeFi applications or transfer their stake without first withdrawing.

-

Composability Constraints: The architecture is not designed for seamless integration with other TON DeFi protocols or for generating liquid staking tokens.

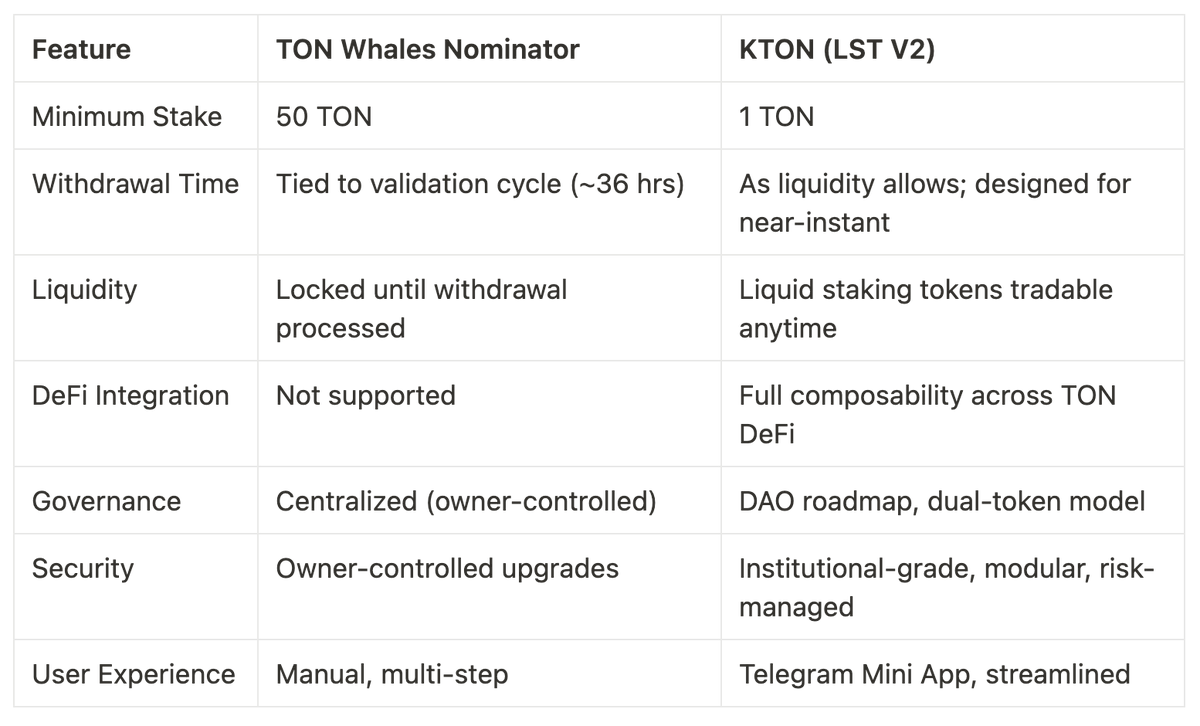

TON Whales Nominator vs. KTON (TonCore LST V2)

While the TON Whales Nominator set the standard for early staking pools, the landscape has evolved. The introduction of liquid staking protocols – most notably KTON’s LST V2 – addresses many of the limitations inherent in traditional nominator pools.

Key Differences

Withdrawal Experience

-

In the Whales Nominator pool, users must wait for the end of a validation cycle and depend on available liquidity.

-

KTON’s LST V2 introduces a fast withdrawal fee mechanism and advanced liquidity management, aiming to enable instant or near-instant withdrawals as the protocol matures.

Asset Utility

-

Staked TON in the Whales Nominator pool is locked and cannot be used elsewhere until withdrawn.

-

With KTON, users receive liquid staking tokens ($KTON) that can be used in DeFi, traded, or held – unlocking capital efficiency and flexibility.

Security and Governance

-

Whales Nominator relies on a single owner for upgrades and fee management.

-

KTON’s LST V2 offers a more robust, transparent, and decentralized governance structure, supporting safer, community-driven upgrades.

Institutional Considerations

For institutions evaluating staking solutions, several criteria are paramount:

-

Security: KTON’s LST V2 introduces advanced risk controls and modular upgrades, reducing single-point-of-failure risks present in owner-controlled pools.

-

Liquidity: The ability to exit positions quickly is crucial for treasury management. KTON’s design is specifically aimed at minimizing withdrawal delays.

-

Composability: Institutions increasingly seek to use staked assets as collateral or in other DeFi strategies – a feature only possible with liquid staking tokens like $KTON.

-

Transparency: KTON’s dual-token model and DAO roadmap offer greater transparency and alignment with institutional governance standards.

User Experience: From Manual to Seamless

The Whales Nominator pool requires nominators to send specific messages with correct capitalization and manage deposit/withdrawal fees manually – a process that can be error-prone.

KTON, by contrast, offers a streamlined experience via its Telegram Mini App, lowering the barrier to entry for both retail and institutional participants and supporting mass adoption across the TON ecosystem.

The Future of Staking on TON

The TON Whales Nominator pool played a critical role in making staking accessible and collaborative. However, as the ecosystem evolves, the demand for greater liquidity, flexibility, and DeFi integration is driving the adoption of liquid staking protocols like KTON’s LST V2.

For institutions, staking enthusiasts, and the TON community, the choice increasingly comes down to what matters most:

-

Immediate access to funds

-

Utility of staked assets

-

Governance transparency

-

Integration with the broader DeFi ecosystem

KTON’s LST V2 is designed to meet these needs, setting a new benchmark for what’s possible on TON.

The TON Whales Nominator remains a foundational staking solution, offering accessibility and simplicity. Yet, for those seeking institutional-grade security, instant liquidity, and seamless DeFi integration, next-generation protocols like KTON’s LST V2 represent the future.

For a deeper understanding of how TonCore LST V2 is transforming liquid staking on TON and powering KTON’s next-generation protocol, read the first article in this series.

Read more: Ton Core LST V2 Upgrade Fuels KTON’s Next-Gen Liquid Staking

Stay tuned for further deep dives into TON’s evolving staking ecosystem.

Explore the future of staking. Visit kton.io.

Ready to stake your TON? Visit kton.io or t.me/ktonio_bot

Follow @KTON_io and join the community: https://t.me/kton_group

About KTON

KTON is a next-generation liquid staking protocol built for the TON ecosystem, unlocking liquidity for both institutional and retail users.

Through its liquid staking token $KTON, users earn staking rewards while accessing TON’s growing DeFi landscape.

Backed by institutional-grade security, decentralized governance, and seamless DeFi integration, KTON drives the growth of Telegram Finance and mass adoption.